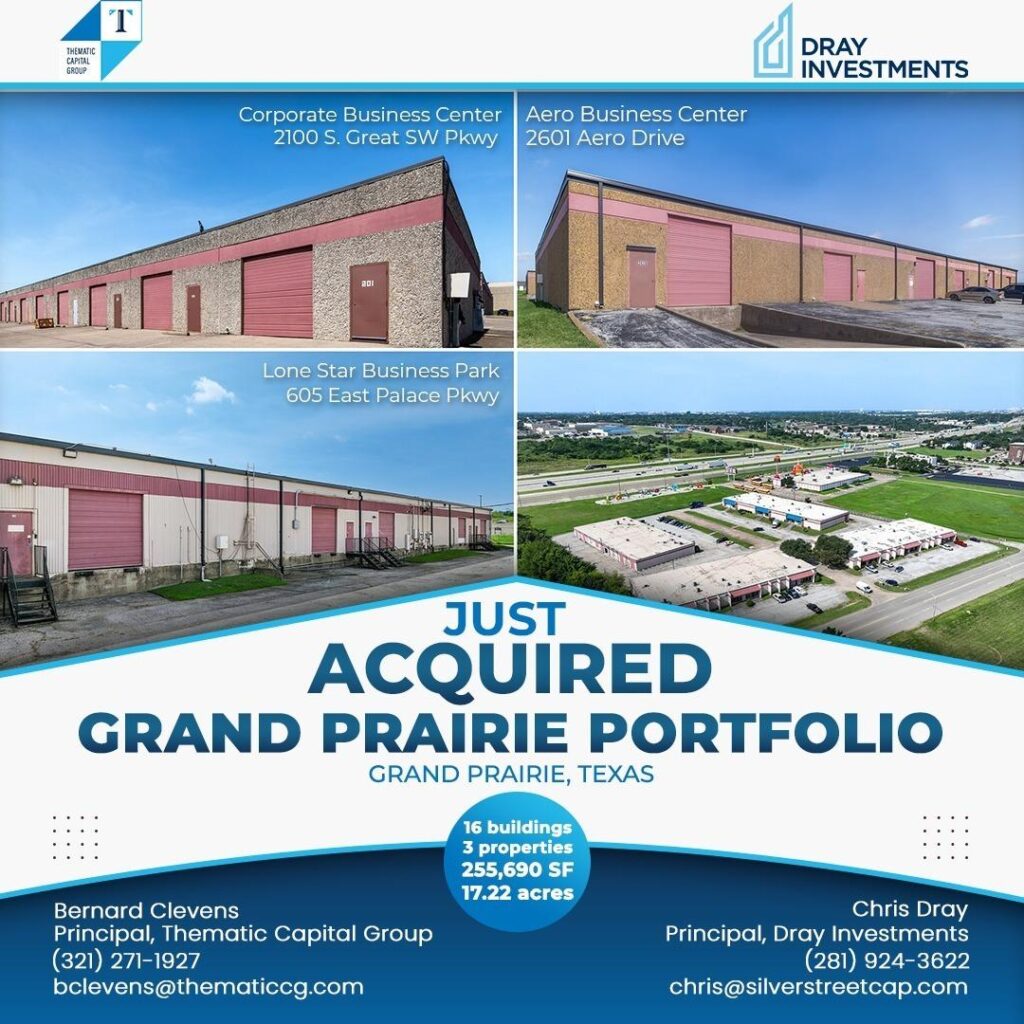

TCG CLOSES 16-BUILDING SMALL BAY ACQUISITION

Thematic Capital Group (TCG), a privately held industrial real estate investment firm, closed on the acquisition of a 16-building, 256,000 SF small bay portfolio in Grand Prairie, an infill urban submarket of the Dallas-Fort Worth Metroplex.

The portfolio was acquired off-market in partnership with Dray Investments, a Houston-based investment firm with a strong track record of operational excellence. This transaction reinforces TCG’s reputation for sourcing high-demand assets in desirable investment markets. Dray Investments boasts a +/-25-year track record as a market-leading operator of industrial, retail and flex assets across Texas.

The portfolio of 16 multi-tenant buildings across three industrial parks provides a range of suite sizes and layouts to accommodate the growing tenant demand in the region. Current occupancy is 80 percent, offering the venture an opportunity to lease-up vacant space, convert under-market leases and execute on a targeted capital improvement plan to elevate the assets to best-in-class condition.

Dallas-Fort Worth’s small-bay industrial sector has demonstrated consistent outperformance across cycles, buoyed by supply constraints, growing in-migration and sustained tenant demand. The Grand Prairie submarkets specifically offer limited industrial supply, rising rents and strong demographic tailwinds.